Wolfspeed, a leading manufacturer of silicon carbide chips, has seen its stock plummet to a 27-year low as uncertainty surrounding federal funding casts a shadow over its ambitious expansion plans. The company’s shares dropped sharply following concerns that crucial government subsidies may not materialize as expected, putting its long-term growth strategy at risk.

A Critical Moment for Wolfspeed

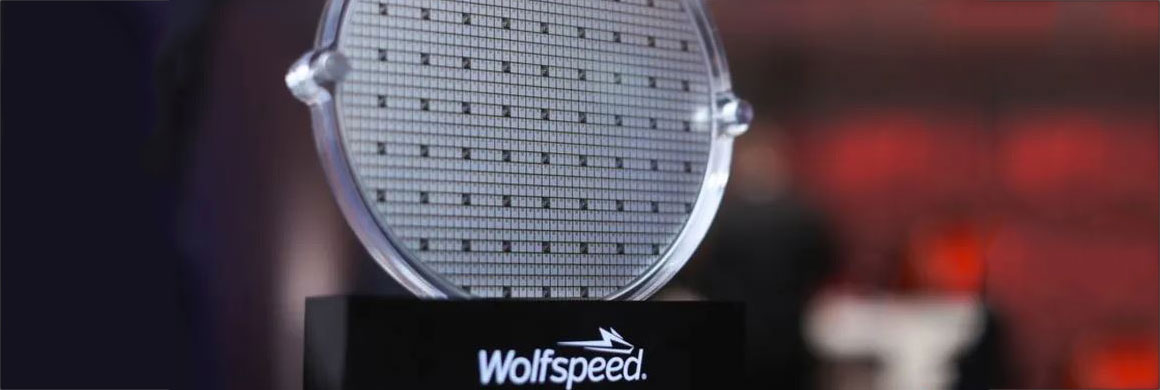

Wolfspeed has positioned itself at the forefront of the semiconductor industry’s shift toward silicon carbide, a material that offers superior efficiency for electric vehicles (EVs), renewable energy systems, and industrial applications. The company has been banking on federal incentives, particularly from the CHIPS and Science Act, to support the development of its next-generation semiconductor facilities. However, delays and ambiguity regarding the allocation of these funds have spooked investors, triggering a mass sell-off.

The company’s shares tumbled to their lowest levels since 1997, wiping out billions in market value and raising concerns about Wolfspeed’s ability to execute its ambitious manufacturing expansion without sufficient financial backing.

Government Support in Question

The CHIPS Act, passed in 2022, aimed to bolster domestic semiconductor manufacturing in response to global supply chain disruptions. Wolfspeed had been one of the hopeful beneficiaries, planning to invest heavily in U.S.-based production. However, as the process of fund distribution has slowed and competing demands have emerged, questions linger over whether Wolfspeed will receive the full support it anticipated.

Analysts suggest that without timely government assistance, the company may struggle to scale operations as planned, leading to potential production bottlenecks and missed market opportunities. “The industry needs certainty, and right now, Wolfspeed faces significant uncertainty,” said a semiconductor sector analyst.

Market Reaction and Future Outlook

The steep decline in Wolfspeed’s stock underscores broader investor concerns about the semiconductor market’s reliance on government funding. While the company remains a key player in the silicon carbide space, the lack of immediate federal support has created doubts about its short-term financial health.

Despite the turbulence, Wolfspeed remains optimistic about its long-term prospects. Company executives have reassured stakeholders that they are actively exploring alternative funding avenues, including private investments and strategic partnerships, to bridge the gap if federal aid falls short.

As Wolfspeed navigates these financial hurdles, the semiconductor industry will be closely watching whether the U.S. government accelerates funding approvals to maintain America’s competitiveness in chip manufacturing. Until then, uncertainty will likely continue to weigh on Wolfspeed’s stock performance.